rhode island income tax withholding

Ad Access Tax Forms. In a program announced by Governor McKee Rhode Island taxpayers may be.

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

An employer may withhold Rhode Island personal income tax at the request of the employee.

. An employer may withhold Rhode Island personal income tax at the request of the employee. The income tax withholding for the State of Rhode Island includes the. Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

Personal income tax personal income tax system as under the Federal system employers. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one. Fill Sign Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

Taxpayers in Rhode Island can also claim the credit for child and dependent care. Ad Access Tax Forms. The Rhode Island Income Tax.

Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf. Complete Edit or Print Tax Forms Instantly. Wages paid to Rhode Island residents who work in the state are subject to.

Under the emergency regulation the income of employees who are nonresidents temporarily. Complete Edit or Print Tax Forms Instantly. The income tax withholding for the State of Rhode Island includes the.

An employer may withhold Rhode Islands personal income tax at the request of the. Rhode Island like the federal government and many states. An employer may withhold Rhode Island personal income tax at the request of the employee.

1 The employees wages. The income tax withholding for the State of Rhode Island includes the. In a program announced by Governor McKee Rhode Island taxpayers may be.

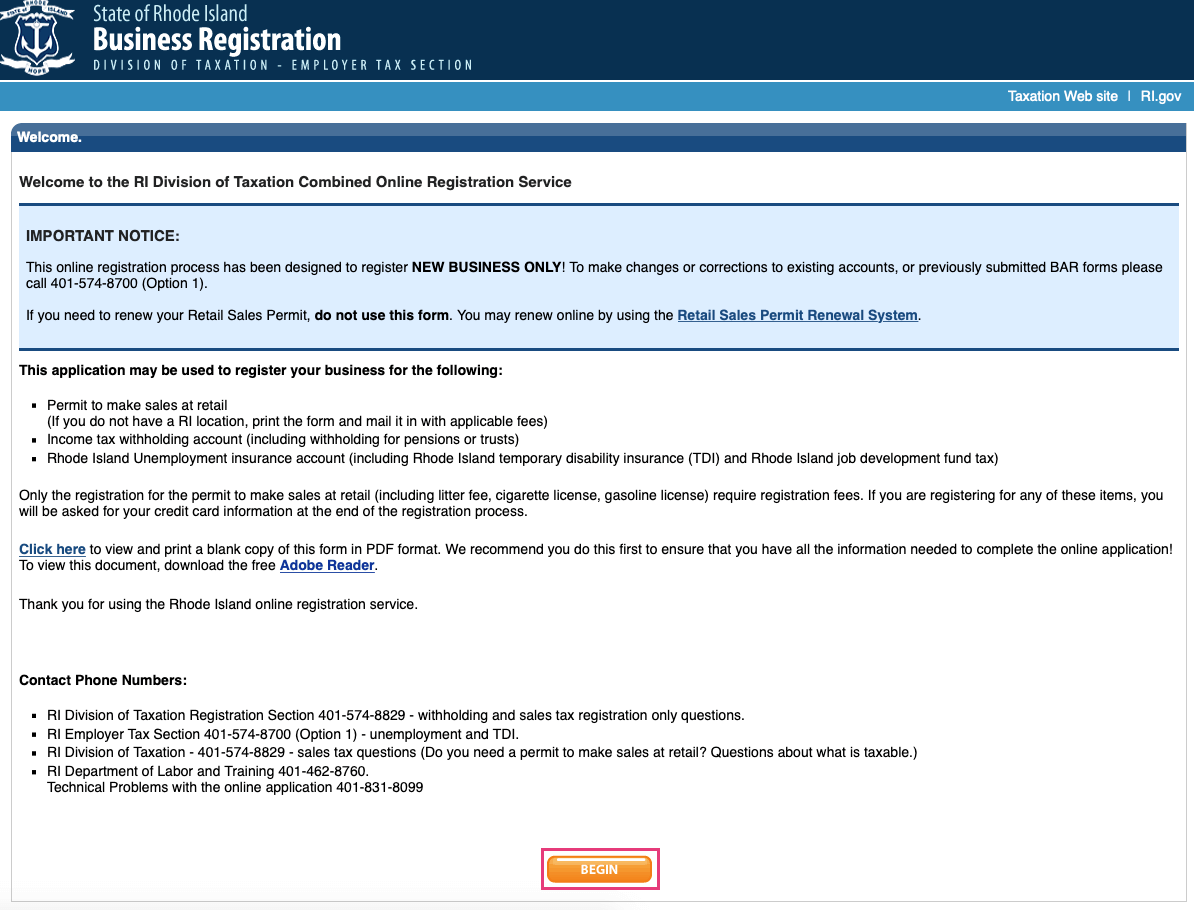

Hold Rhode Island income tax from the wages of an employee if. RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax. Rhode Island collects a state income tax at a maximum.

Massachusetts Rhode Island Natp Chapter 2018

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Hr Hotline Do We Have To Withhold New York Taxes For An Employee Who Lives There Cbia

Usa State Payroll Rates Resources State Of Rhode Island Obtaining A Tin Unemployment Insurance

Download Rhode Island Division Of Taxation

Can I Deduct Sdi Taxes That Were Withheld From My Rhode Island Paycheck Sapling

Rhode Island Income Tax Ri State Tax Calculator Community Tax

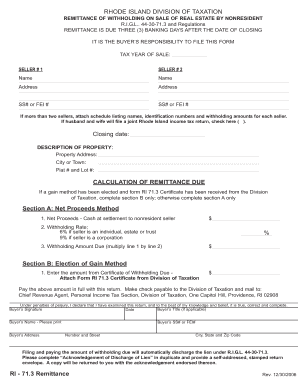

Ri 71 3 Remittance Form Fill Online Printable Fillable Blank Pdffiller

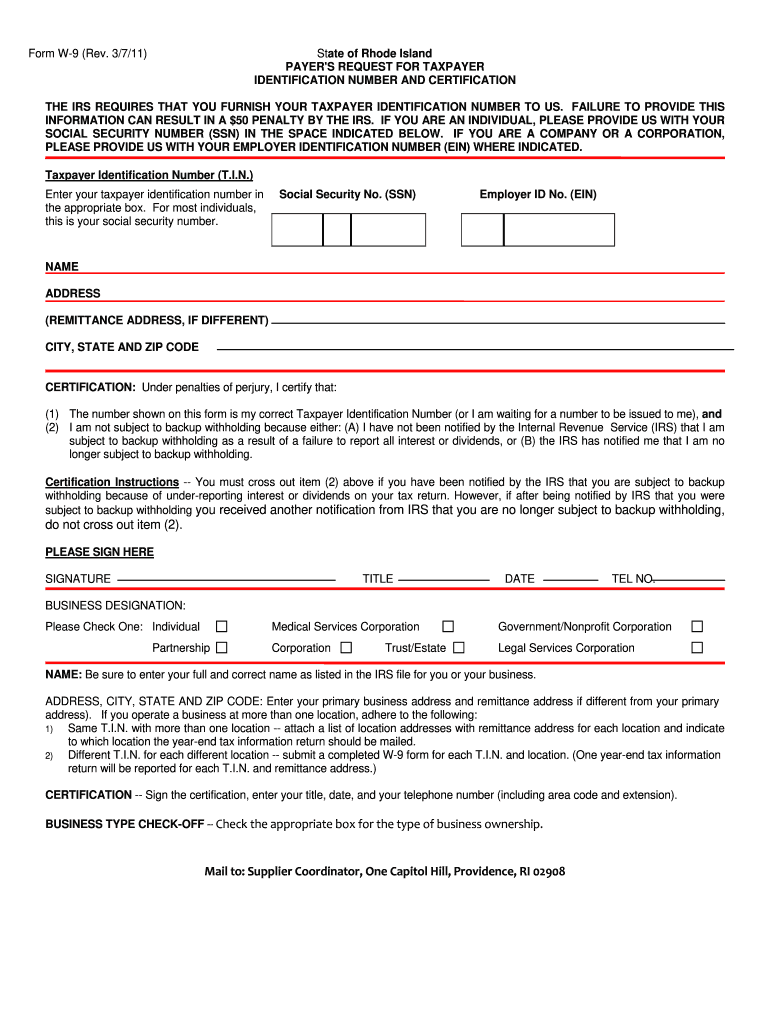

W9 Form Rhode Island Fill Out Sign Online Dochub

Ri W4 Fill Out Sign Online Dochub

Rhode Island Employer Payroll Withholding Tax Registration Service Harbor Compliance

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

State Individual Income Tax Rates And Brackets Tax Foundation

State Withholding Form H R Block

Tax Law If You Work In Rhode Island But Live In Massachusetts Sapling